France’s winegrowers are facing declining sales at home and abroad compounded by falling producer prices, despite achieving an above-average grape harvest last year. The situation has been caused by rising inflation and the fact that the French are drinking less wine, the Agriculture Ministry said in its latest market analysis. The 2023 grape harvest should…

Skier Francis Zuber sprang into action when he noticed a snowboarder had become trapped upside down in a tree well. Zuber, whose reaction has been applauded as a textbook example of what to do in such a situation, urged others to take up rescue courses. SOURCE: https://www.cnn.com/videos/us/2023/03/31/snowboarder-rescue-mt-baker-washington-cprog-lon-orig-na.cnn

A Palestinian taxi driver describes surviving a violent attack by a right-wing mob in Jerusalem earlier this week as Israel continues to see protests against Prime Minister Benjamin Netanyahu’s judicial overhaul spread. CNN’s Nic Robertson reports. SOURCE: https://www.cnn.com/videos/world/2023/03/31/israel-protests-rise-taxi-driver-attacked-robertson-pkg-intl-vpx.cnn

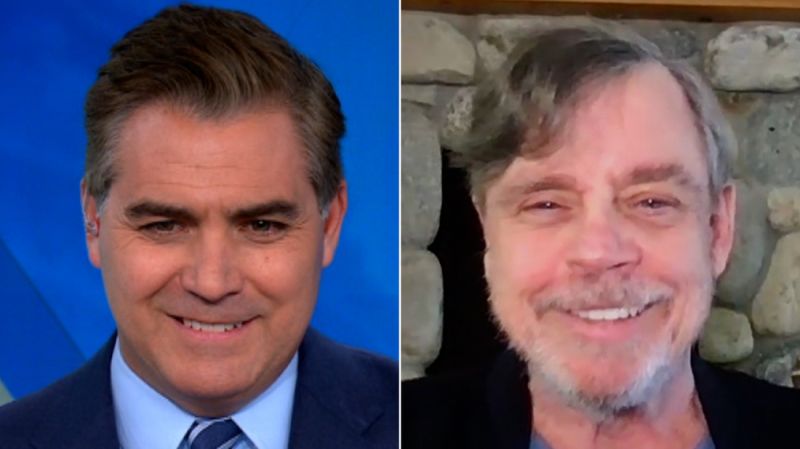

Actor Mark Hamill joins CNN’s Jim Acosta to discuss his thoughts about a potential spinoff series based around his legendary “Star Wars” character Luke Skywalker. SOURCE: https://www.cnn.com/videos/media/2023/04/02/mark-hamill-star-wars-jim-acosta-skywalker-cprog-acostanr-vpx.cnn

Analyzing the impact of net neutrality repeal on ISP profit using techno-economic modeling and MILP optimization in video delivery networks. SOURCE: https://hackernoon.com/impact-of-the-net-neutrality-repeal-on-communication-networks-abstract-and-introduction?source=rss

Analyzing the impact of net neutrality repeal on ISP profit using techno-economic modeling and MILP optimization in video delivery networks. SOURCE: https://hackernoon.com/impact-of-the-net-neutrality-repeal-on-communication-networks-related-works?source=rss

Analyzing the impact of net neutrality repeal on ISP profit using techno-economic modeling and MILP optimization in video delivery networks. SOURCE: https://hackernoon.com/impact-of-the-net-neutrality-repeal-on-communication-networks-repealing-net-neutrality?source=rss

Cody Coombes recounts riding out a tornado in Little Rock, Arkansas, inside his pest control van. The National Weather Service reported that an EF-3 tornado had roared through Pulaski and Lonoke counties with estimated peak winds of 165 mph, killing one person in North Little Rock and four people in Wynne. SOURCE: https://www.cnn.com/videos/weather/2023/04/02/little-rock-arkansas-tornado-man-inside-van-cnntmw-vpx.cnn

Discover the challenges deepfakes pose to legal systems, undermining evidence trust and courtroom integrity. SOURCE: https://hackernoon.com/ai-and-the-law-deepfakes-eroding-trust-and-the-legal-tightrope?source=rss

millimeter-wave FMCW radar: efficient, environmental-independent sensing for device integration and advanced consumer electronics SOURCE: https://hackernoon.com/deep-learning-edge-devices-with-mmwave-fmcw-radars-part-1-signal-processing?source=rss