Running a construction business (including agencies, and small or medium-sized companies) is a challenge in itself. In such a digital world, where competitors can keep track of every activity you perform, using software to maintain the data of your business is of prime importance.

Many contractors or other accounting professionals call it QuickBooks. However one should understand the fact that the cost you spend on your businesses doesn’t become higher than revenue.

Else it becomes difficult to showcase your expenses smartly and survive in the construction business!! But what if the contractors are well-versed in aspects like job costing, taxes, payroll, and administration?

In such a case navigating features of QuickBooks for Contractors within the software can help them create job ids robustly. Even the Enterprise version of QuickBooks can showcase what their business is doing overall at a pretty low price.

You might be thinking about the factors that can seamlessly roll down which projects are generating higher revenue and which are not performing well.

With the help of these parameters, you can easily keep a track of invoices and other expenses without even entering the details manually.

Terminologies on which construction businesses rely upon

One should confuse regular accounting with construction accounting. There are various factors of construction accounting involved that leave a long-lasting impact on the construction businesses.

Unlike balance sheets, construction accounting prefers to use the cash basis method for determining flaws and flaunts into contracts. This type of methodology can potentially account for your expenses and income with a minimal error rate.

Many training programs are developed for contractors to offer them industry-relevant knowledge related to accounting software. The sole purpose of doing the same is – to make them aware of the perils of the construction business.

Furthermore, four aspects of accounting are covered by all versions of QuickBooks software (pro, premier, or enterprise). The first one is: –

- Job Costing and Estimating

It is an important aspect of accounting. Without job costing, one can exponentially not analyze the shortcomings in expenses and actual costs. In different construction projects, job costing can easily break down various entities like labor, maintenance, wages, and so on without any hustle.

There are many benefits to job hosting. First is that it becomes easier to categorize the job based on complexity and pricing. Second is that customers will not surprise you nastily with quarrels on wrong invoices and reworks.

Third, it is much easier to track the progress made by the business and the calculative margin you get on a timely basis. Similarly, there are other benefits also that you can easily find in the software – QuickBooks for Contractors.

But one can’t ignore the fact that estimating the expenses spent on labor, hardware maintenance and other raw materials of any construction business is a part of job costing. If some contractor plans to execute activities on a construction site neglecting the aspects of job costing and estimation there are chances of encountering a negative drilled-down outcome within a week or two.

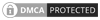

- Cash Flow Reporting

In various versions of QuickBooks like Pro, QuickBooks Desktop, and others, cash flow reporting is unavoidable. Whether we talk about accountants or contractors, getting statements like invoices, expense reports, etc is a must for the corresponding job posts.

Furthermore, cash flow reporting consists of a series of cash flow statements turning out fruitful in predicting the actual cost upfront. Even the financial analysis estimated by such kind of reporting makes it easier for companies to fund their operational expenses whenever required.

If we talk about accounting many investors and creditors seek help from cash flow reporting estimates in determining the expenses and sales generated every month through the company’s goods and services.

On an overall basis, it is much more scalable to keep a track of taxes, incomes, and expenditures on various commodities/raw materials used by big giants or contractors in construction accounting.

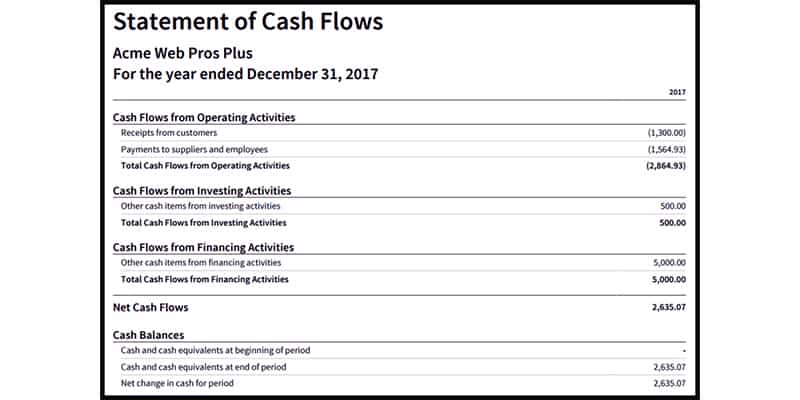

- Payroll

With an efficient payroll system, it becomes much easier to perform various activities of financial accounting. At times you use versions of QuickBooks the software has two sets of functionalities – standard and advanced payrolls.

Setting up deductions, employee benefits, and other aspects of the administration are pretty much easier with QuickBooks. Furthermore, it is much more feasible to access all these aspects of payroll in T-Sheets – an app for construction workers.

With its help, various crews of contractors can reliably manage the workforce assigned to them as per the job posts. Indistinguishably, the award-winning time tracking solutions delivered in real-time is possible if the permissions are correctly allotted as per the designations.

For instance, making amendments to task flow should only be done by managers and administrators, not by employers. Such kind of scheduling in administration makes the payroll section drive profit-oriented results within the time.

- Year-End and Taxes

QuickBooks has made closeouts much easier. After you log in with your credentials just select the year(s) through the necessary add-ons. Later you can review various tax forms like 1040EZ, W-2, W-4P, and so on.

All this might be difficult for a contractor having less experience in rolling out annual reports on the computer. They can pursue QuickBooks for contractors programs and get industry-relevant guidance on aspects of taxes, ITRs, capital, investment, equity, and other liabilities.

Besides, many of the invoices consist of withholding taxes. Such a kind of tax doesn’t allow numerous clients to pay the complete amount. But thanks to the advance tax return option in QuickBooks. It not only gives a return on withholding taxes but also streamlines the ways the business market conducts dealings of various commodities.

Tips for Construction Engineers Using QuickBooks for Business

Though QuickBooks can assertively handle tons of clients’ requirements yet contractors or other construction engineers worried about raw materials and other things need to follow a few tips.

These tips not only guide them well about the software but also make navigation of its functionalities much simpler.

#Tip 1 -> Seeking help from QuickBooks experts at the initial setup

QuickBooks has various versions in the market depending upon the customers’ requirements. For companies with more than a thousand employees, QuickBooks Enterprise is there. Similarly, businesses with small-scale employee sizes use QuickBooks Pro and Premier Versions.

However, every version consists of different packages for further installation and maintenance.

There are chances that a contractor using QuickBooks for accessing previous records might get stuck in logging into his/her account. In such a case it becomes essential to perform the procedures like account creation, customization, accepting the license policies after reviewing them, and chart-of-accounts.

If you are new to QuickBooks you must seek advice from a bookkeeper, accountant, or an experienced QuickBooks user. The benefit is that the concerned person will guide you through the chart of accounts (the type of account that you fit the best) so that you can effortlessly track the expenses, capital, investment, and payroll activities of your business – either construction or accounting.

Another benefit of consulting is that experts will guide you about the calculations related to expenses, salaries, deductions, taxes, and so on. This is important because even minor mistakes in such areas may result in unexpected losses – big or small.

These are some of the benefits you will get after performing the setup procedures like QuickBooks software installation, account creation, customization, and so on. In short, seeking advice from professionals helps you track all your expenses and profits in the long run.

#Tip 2 -> Classifying prevailing wages as per the pay items

Prevailing wages comprise a bidding framework onto which various states and countries decide compensation, salaries, and other employment benefits for their workers. If you are someone who studied construction accounting or implying its principles in your ongoing business it is difficult to neglect prevailing wages.

Various federally funded projects outsmart the difference between a worker and an apprentice based on the category of prevailing wages. The more the worker has an hourly charge the better the chances of getting promoted.

Majorly many of contractors prefer to use QuickBooks Online to fetch the details of their workers and assign them the pay items suitable to their category and capability.

Moreover, all these details are stored in a certified payroll report which can be accessed anytime to find appropriate wage information just by following a few on-screen instructions.

This type of wage system pays workers the wages (including overtime and other compensatory benefits) they deserve as per their performance. As a result, it helps such contractors classify the unions and do further categorization based on the pay items processed by them during their daily workloads.

#Tip 3 -> Tracking retainage as per the construction projects

Retainage is a negative entity linked to your billing account. The entity is subjected to a particular amount that has to be deducted from every invoice created. Many a time it becomes difficult to track such retainages when you are working on any of the construction projects.

This is so because there are many invoices linked with them. Hence contractors must use multiple spreadsheets while working on the retention payable and receivable balances section.

Furthermore, some ways can tell the contractors how much the retainage (aka retention amount is) and who are the authorities charging it.

All this not only makes the process simple but also lets the contractors choose the correct chart of accounts and process the necessary amendments in the retainage-related invoices with less confusing calculations.

#Tip 4 -> Using Work-In-Progress Reporting

Work-In-Progress (WIP) reporting is a way of representing the details of an accounting schedule as per GaaP principles. The reporting consists of components like contract value, the period of completion, estimated costs, and so on.

Such a sort of reporting plays a crucial role in construction accounting as it categorizes job numbers assigned by the contractors to their subordinates based on time and cost. Furthermore, QuickBooks lets contractors see the profits and losses derived via such jobs onto a single spreadsheet.

That kind of spreadsheet comprises the comparisons between actual and estimated costs from the current period to the project to date. Even you can select monthly or quarterly periods to compare factors like gross profit, revenue, and so on.

Additionally, you must save the spreadsheet as per the data stored in them. Such scheduled reporting will help you monitor and detect the shortcomings made by your company or stakeholders, investors, or other parties. Later, such schedules can be used in getting an accurate measure of where the company stands financially while investing in such projects.

#Tip 5 -> Correcting entries rather than canceling them

Many professionals like CPAs and other experienced QuickBooks users prefer to bend their heads in a servile manner after listening to deleting a transaction. In accounting, you must not delete the records.

This is so because such entries consist of information you (including the contractors) require at any moment. Hence instead of deleting them, you must rename them to void transactions (like void entry, invoice, etc) and use them later after making necessary adjustments.

The sole purpose of doing this is to create a better solution for using the information to get the desired business results with the utmost efficiency and throughput. Making amendments rather than deleting them is supported by all versions of QuickBooks – Pro, Premier, and Enterprise.

No Doubt QuickBooks still works for Contractors

QuickBooks is such a beneficial software with various add-ons to fulfill all kinds of business requirements. From clearing taxes to making amendments to the current payroll policies seeking help from QuickBooks will not incur losses!!

Additionally while trying to implement the learnings from QuickBooks for Contractors you must keep in mind some of the tips. They may include taking guidance from CPAs and other QuickBooks experts for account creation, using WIP reporting in spreadsheets, assigning pay items as per the prevailing wage category, tracking retainage, and not deleting the entries.

These tips are explained well in this blog. For contractors who prefer to use QuickBooks for retrieving data about their union workers, such tips can be useful for them. They not only offer award-winning solutions but also let them use QuickBooks and its add-ons with less hustle.